Introduction: The US-China Shipping War and Its Global Ripples

The US-China Shipping War marks a new and alarming phase in the world’s two largest economies’ rivalry. After years of trade disputes, sanctions, and diplomatic strains, tensions have now spilled over into the maritime sector — the lifeline of global commerce. With both Washington and Beijing introducing tit-for-tat port fees, the maritime industry faces uncertainty that could reshape global shipping routes, fuel costs, and consumer prices worldwide.

This unfolding conflict, though centered on port tariffs, has deeper geopolitical implications. The US-China Shipping War is not just about economics; it’s about power, control, and the future of global trade dominance.

1. Background: How the US-China Shipping War Began

The current confrontation began when both the United States and China announced reciprocal port fees on vessels originating from or heading to the other’s ports. Initially viewed as a routine tariff adjustment, this move quickly escalated into a full-blown shipping standoff.

China accused the U.S. of using trade regulations to exert pressure, while Washington claimed Beijing’s subsidies and maritime dominance created unfair competition. The result? A tit-for-tat cycle that’s disrupting shipping logistics and unsettling global supply chains.

The US-China Shipping War mirrors earlier economic confrontations — from the 2018 tariff battle to tech restrictions on companies like Huawei and TikTok. But this time, the battlefield is the sea, and the stakes are higher than ever.

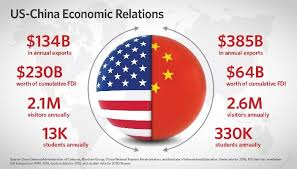

2. Economic Impact: Turmoil Across Global Trade Routes

Shipping plays a pivotal role in global trade, transporting nearly 90% of the world’s goods. Any disruption in this network directly affects prices, supply chains, and economies.

In the US-China Shipping War, increased port fees have already triggered:

- Higher freight charges for importers and exporters.

- Rerouting of vessels through alternative ports in Southeast Asia.

- Rising insurance costs for shipments passing through contested waters.

The ripple effect is visible globally. Consumers may soon see higher prices for electronics, machinery, and raw materials, while smaller economies dependent on maritime exports face reduced trade flows.

For the logistics industry, the U.S.-China standoff is reminiscent of the COVID-19 supply chain crisis, but with a political twist that could last much longer.

3. The Technology and Energy Angle

Beyond trade, the US-China Shipping War has implications for the tech and energy sectors. Many cargo shipments involve high-value goods such as semiconductors, batteries, and energy components, industries already strained by previous trade wars.

China’s heavy investment in green energy exports — including solar panels and EV batteries — faces new hurdles as U.S. tariffs make transportation costlier. Likewise, American exporters of liquefied natural gas (LNG) may find their shipments delayed or rerouted, affecting both economies’ energy strategies.

These frictions highlight how the shipping war intertwines with broader technological competition between the two powers — a race not just for market share, but for strategic global influence.

4. Political Repercussions: Beyond Economics

The US-China Shipping War isn’t merely an economic issue; it’s deeply political. The confrontation underscores a fundamental distrust that has defined U.S.-China relations for over a decade.

Both nations are now leveraging maritime policies as tools of diplomacy and coercion. The U.S. justifies its tariffs under “fair trade” policies, while China retaliates by strengthening alliances with other regional economies under the Belt and Road Initiative (BRI).

In this high-stakes geopolitical chess match, the world watches as two maritime giants vie for dominance in the Pacific — a region vital for both commerce and military strategy.

5. The Role of Shipping Companies and Global Markets

Shipping companies like Maersk, COSCO, and MSC are among the hardest hit by this standoff. Increased port fees and uncertainty in routes have forced them to:

- Adjust global logistics strategies.

- Shift cargo operations to less regulated ports.

- Absorb significant financial losses.

Stock markets have reacted accordingly. Shares in major logistics firms have fluctuated sharply, and analysts warn that if the US-China Shipping War continues, it could wipe out billions in global trade profits.

Meanwhile, insurance companies have raised premiums for shipments through affected routes — another burden ultimately passed down to consumers.

6. Regional Impact: Asia-Pacific Feels the Shockwaves

The Asia-Pacific region sits at the epicenter of this maritime conflict. Countries like Singapore, Vietnam, and Malaysia are witnessing a sudden influx of redirected shipments as businesses seek stable alternatives.

While this has created short-term gains for some ports, it’s also straining capacity and resources. Analysts predict that if tensions continue, regional trade dynamics could shift permanently — with smaller nations becoming key players in global logistics.

This unintentional reshaping of Asia’s trade map could redefine future alliances, especially if companies begin diversifying away from the U.S. and China.

7. Environmental Consequences of the Shipping War

An often-overlooked aspect of the US-China Shipping War is its environmental cost. With vessels rerouted over longer distances to avoid tariff-heavy ports, carbon emissions from global shipping have surged.

Environmental organizations warn that the prolonged conflict could reverse years of progress toward greener maritime operations. Moreover, rising fuel costs encourage shipping companies to use cheaper, dirtier fuels — worsening pollution in coastal areas.

Thus, the battle between superpowers has inadvertently sparked a climate setback, adding another dimension to an already complex issue.

8. The Future of Global Maritime Policy

If the US-China Shipping War persists, global institutions such as the World Trade Organization (WTO) and the International Maritime Organization (IMO) may be forced to intervene. Calls for standardized global shipping fees and dispute mechanisms are growing louder.

However, without cooperation between Washington and Beijing, meaningful reform remains unlikely. Experts suggest that the world might soon see parallel maritime systems — one dominated by China’s BRI network and another aligned with U.S.-led trade blocs.

This fragmentation could make global trade slower, costlier, and more politically charged than ever before.

9. The Human Element: Workers and Consumers Caught in the Crossfire

Amid these macroeconomic battles, the real losers are often ordinary people — seafarers, port workers, and consumers.

Thousands of dockworkers face reduced hours as shipping volumes drop. Independent exporters and importers, especially small businesses, struggle to stay afloat amid soaring logistics costs. Consumers, meanwhile, experience inflation as companies pass on higher transport costs.

The US-China Shipping War may be a geopolitical contest, but its consequences are felt in every home that depends on global goods.

10. Conclusion: Navigating Through Uncertain Waters

The US-China Shipping War stands as a defining conflict of this decade — not just for its economic repercussions, but for what it symbolizes: the struggle for control over the arteries of global trade.

While port fees might seem like bureaucratic details, their impact reaches deep into international economics, climate policy, and human livelihoods. The world now sails into an era where trade routes are weapons, and diplomacy happens not in conference halls, but across the open seas.

Whether cooperation or confrontation prevails will shape not just shipping, but the entire future of global commerce.