Brent Crude Spikes across global energy markets after former U.S. President Donald Trump claimed that Indian Prime Minister Narendra Modi had promised to halt the nation’s purchases of Russian oil. The statement, made during a press briefing in Washington D.C., sent a wave of speculation through the commodities market, pushing prices upward and igniting debate about how the decision could reshape international energy trade.

Oil traders and economists quickly reacted, with analysts suggesting that the remark alone was enough to cause volatility. Since India has become one of the largest importers of discounted Russian crude since 2022, any suggestion that it may scale back or stop those imports immediately affects global sentiment. Even without formal confirmation from New Delhi, the words “India will quit Russian oil” were enough to move prices higher.

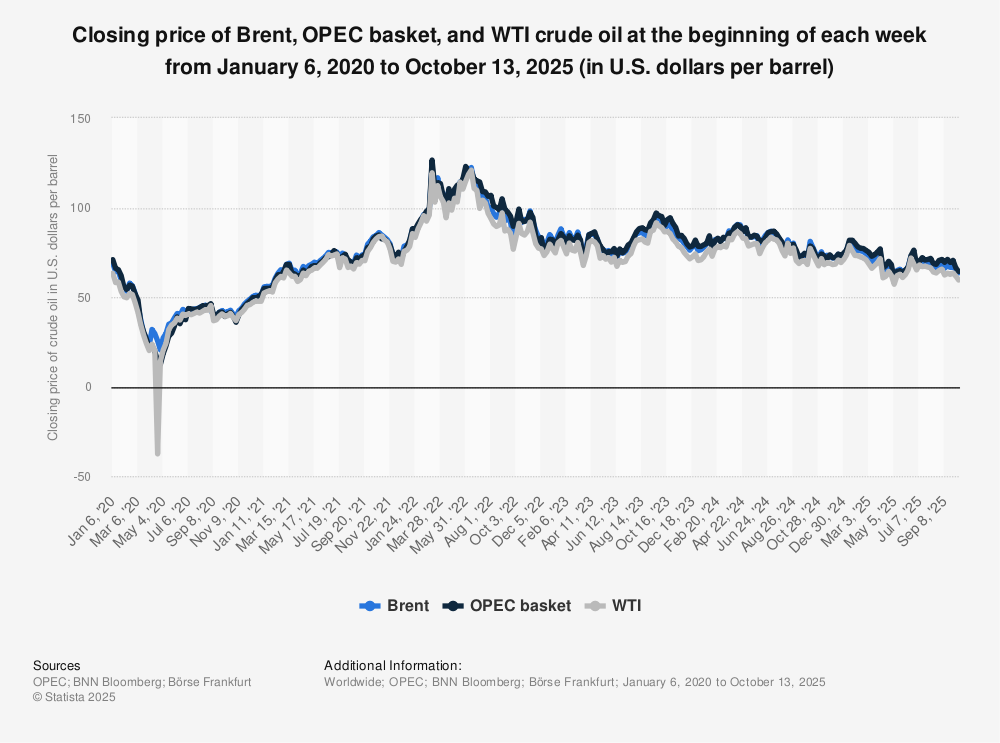

The rise in Brent Crude Futures—nearly 1% within hours—marks another chapter in how politics and energy remain inseparable. For months, prices had hovered around multi-year lows amid oversupply fears. Then, one statement from a former U.S. president shifted the direction of the market overnight.

The Background of the Statement

Trump’s comment came during a Q&A session with journalists when he was asked about U.S. diplomacy toward major oil-buying nations. He stated that he had spoken with Indian Prime Minister Modi, who “agreed that India would no longer buy oil from Russia.” The White House did not provide supporting documentation, and India’s Ministry of External Affairs offered a carefully worded response: India will “continue to prioritize stable energy supplies at affordable prices.”

That diplomatic phrasing neither confirmed nor denied Trump’s assertion, but the markets didn’t wait for clarity. Traders, always hungry for headlines that signal potential supply shifts, acted instantly. Within minutes, futures contracts for Brent crude jumped 56 cents to $62.47 per barrel, while West Texas Intermediate (WTI) crude gained nearly 1%.

The phrase Brent Crude Spikes quickly trended on financial news sites as investors recalibrated expectations for global supply.

Why India Matters So Much

India ranks among the world’s top three crude importers, along with China and the United States. Following Western sanctions on Russia in 2022, Moscow redirected its oil flows toward Asian buyers at discounted prices. India seized the opportunity, saving billions of dollars while ensuring energy security for its rapidly growing economy.

If India genuinely stopped buying Russian oil, it would remove one of Russia’s most dependable revenue streams. In turn, Russia might be forced to cut production, reroute cargoes, or offer even steeper discounts to remaining customers such as China or Turkey.

For the rest of the world, that could mean tighter supplies in the open market. Even if Russia continues to produce, logistical bottlenecks and fewer buyers can increase costs across the supply chain. As a result, Brent Crude Spikes become not just a short-term reaction but a potential long-term trend if diplomatic tensions persist.

Market Reaction and Analyst Opinions

Energy analysts describe the episode as a classic case of “headline volatility.” Markets, they note, are hypersensitive to political soundbites in the post-pandemic era. A few key reactions from global experts highlight the uncertainty:

- Goldman Sachs analysts noted that any credible threat of reduced Indian purchases could add “two to three dollars per barrel” to Brent in the short term.

- JP Morgan Chase warned that the move could trigger “a fresh round of supply rebalancing,” potentially pushing prices toward $65–70 if other Asian buyers do not compensate.

- Energy Aspects, a London-based research firm, suggested that India’s state refiners are already diversifying away from Russian blends due to payment issues and shipping constraints.

At the same time, skeptics caution that markets might have overreacted. Until concrete trade data show a drop in Russian cargo arrivals to Indian ports, the phrase India quits Russian oil remains speculative.

Still, perception drives price. As Brent Crude Spikes, so do discussions about whether the world has entered a new phase of politically driven oil shocks.

The Global Energy Shock Explained

When oil prices move upward, the effects ripple far beyond trading floors. Airlines, manufacturing firms, shipping companies, and even agriculture—all depend on affordable fuel. A one-dollar increase in the price of Brent can add millions in extra costs for these industries.

In the days following Trump’s comment, energy companies from Asia to Europe began recalculating budgets. Shipping indexes ticked upward, and fuel surcharges reappeared in some transportation contracts. The global energy shock isn’t merely about crude barrels; it’s about inflation expectations and consumer confidence.

Brent Crude Spikes become the headline shorthand for a chain reaction: higher production costs → pricier transportation → rising consumer prices → potential pressure on central banks to maintain tight monetary policies.

Economists recall similar patterns from 2018 and 2022, when geopolitical tensions triggered temporary oil surges that later cooled once diplomacy stabilized. Whether 2025 follows that script depends largely on India’s actual behavior and how Russia, the U.S., and OPEC respond.

India’s Delicate Balancing Act

For India, the decision isn’t simple. Russian oil—sold at discounted rates—has allowed New Delhi to control domestic fuel inflation. Refineries like Indian Oil Corp and Bharat Petroleum have optimized operations for Russian blends such as Urals and ESPO. A sudden cutoff could require expensive recalibration.

Moreover, India’s foreign-policy strategy emphasizes “strategic autonomy.” It seeks strong relations with both Washington and Moscow without committing fully to either side’s agenda. Thus, while Trump’s statement may reflect diplomatic persuasion, it’s unlikely that India will impose a full ban overnight.

Still, even a modest reduction could tighten global supplies enough to sustain current price momentum. That’s why Brent Crude Spikes remain on traders’ radar.

U.S. Pressure on Other Nations

The Reuters report also mentioned that U.S. Treasury Secretary Janet Yellen urged Japan to reduce Russian energy imports. Combined with Trump’s comments about India, it suggests a broader American push to further isolate Moscow’s oil revenues.

If multiple Asian importers comply, the balance of power in global energy could tilt again toward OPEC producers like Saudi Arabia and the UAE. These nations might use the opportunity to regain pricing influence, which had eroded due to discounted Russian exports.

In that scenario, Brent Crude Spikes might extend beyond a short-term political blip to a sustained upward cycle.

The Role of Speculation and Algorithmic Trading

Modern oil markets are heavily influenced by algorithms that react within milliseconds to breaking news. Once Trump’s quote hit social-media feeds, automated trading systems began buying futures based on keyword triggers like “India,” “Russia,” and “oil imports.”

This wave of speculative buying amplified the movement. Even traders skeptical of Trump’s claim joined the rally to avoid being left behind—a phenomenon known as “fear of missing out.”

Financial experts argue that while this technology improves liquidity, it also magnifies volatility. One sentence from a politician can move billions of dollars instantly, proving again why Brent Crude Spikes have become a recurring feature of today’s interconnected markets.

Broader Economic Implications

Higher oil prices often translate into higher inflation. Central banks in Asia and Europe, already cautious about slow growth, may find themselves under renewed pressure to maintain restrictive policies.

For developing countries reliant on fuel subsidies, rising oil prices mean larger budget deficits. Nations such as Pakistan, Bangladesh, and Sri Lanka could face fiscal stress if prices remain elevated for long.

Meanwhile, oil-exporting countries benefit—at least initially. Russia, Saudi Arabia, and Iraq could see temporary revenue boosts even amid geopolitical uncertainty. Yet, if sanctions tighten further or trade routes are disrupted, the positive effects might fade quickly.

This intricate web of winners and losers shows why analysts say Brent Crude Spikes never happen in isolation—they reshape the global economy’s delicate balance.

Environmental and Policy Angle

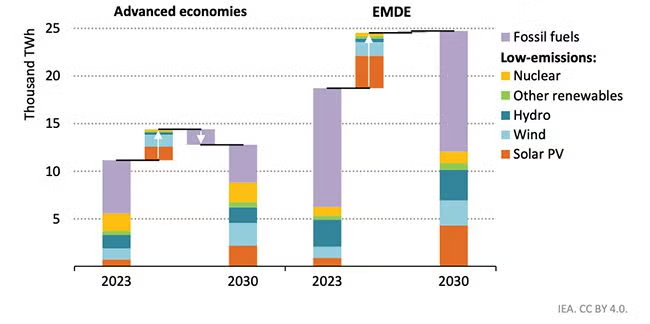

The sudden jump in oil prices also reignites discussion about energy transition. When fossil-fuel costs rise, renewable energy becomes relatively more attractive. Governments in Europe and Asia may accelerate investments in solar and wind to reduce exposure to oil volatility.

However, critics warn that such spikes can also slow the transition. Developing nations divert funds to cover immediate fuel needs rather than green projects. Thus, each time Brent Crude Spikes, the climate agenda faces both opportunity and risk.

Future Outlook

Most energy forecasts suggest that volatility will continue. Traders will closely watch India’s import data, Russia’s export strategies, and OPEC’s production targets. Any confirmation that India has actually reduced Russian purchases could push Brent beyond $65 per barrel. Conversely, a denial or clarification might trigger a correction.

Experts expect further comments from both Indian and U.S. officials in the coming weeks. Until then, the market will operate on uncertainty—fertile ground for more headlines reading Brent Crude Spikes.