What dependence on China means for medicines

Dependence on China means that a large share of the active pharmaceutical ingredients (APIs) and key starting materials used in U.S. medicines are produced in Chinese factories. These are the core chemical components that make drugs effective, so if their supply stops, American companies cannot easily make the final products.

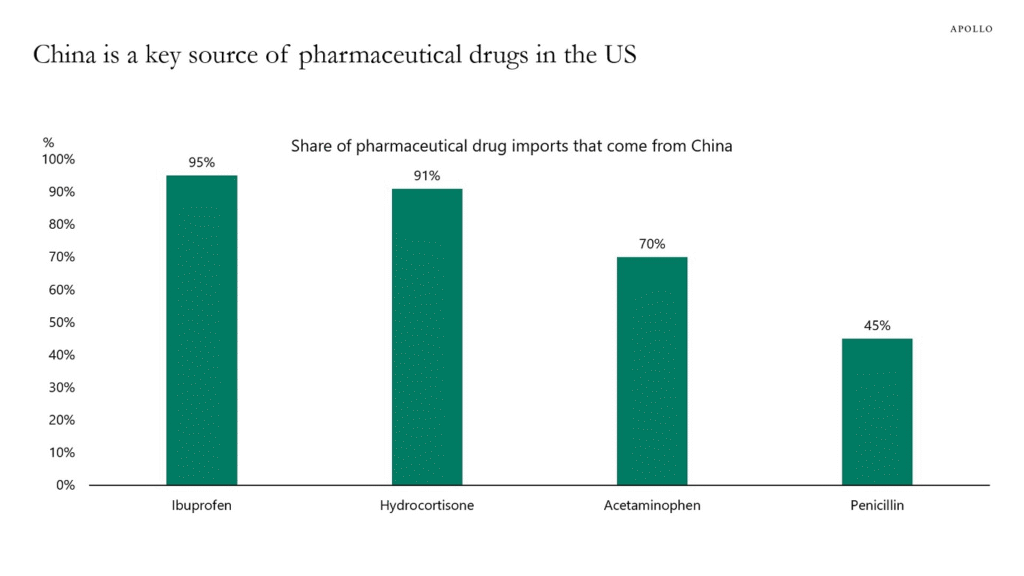

Recent studies estimate that Chinese APIs or chemical inputs are involved in a significant portion of generic drugs sold in the United States, sometimes directly and sometimes through India and other countries. In some specific categories of critical inputs, China controls more than three‑quarters of U.S. imports, and for a few ingredients its share is close to total dominance.

How dependence on China became so deep

This dependence on China did not appear overnight; it developed over decades as companies chased lower costs and governments trusted global markets to stay stable. Many older plants in the United States and Europe closed or reduced operations when they could not compete with cheaper Chinese producers.

Beijing, meanwhile, treated pharmaceuticals as a strategic industry and supported it with subsidies, industrial plans, and flexible rules. This allowed Chinese firms to expand capacity, undercut rivals on price, and gradually become essential suppliers for many drug ingredients used around the world.

Why this dependence is a national security risk

Dependence on China in the drug supply chain creates a strategic chokepoint for the United States. If factories in China slow production, face internal problems, or if Beijing limits exports during a political dispute, U.S. hospitals and pharmacies could rapidly run short of life‑saving drugs.

Analysts warn that pharmaceuticals could become a trade weapon, similar to how energy and rare earths have been used in past disputes. The risk is especially serious for the U.S. military and emergency systems because some medicines used by troops and in critical care depend heavily on Chinese‑linked ingredients.

Evidence of growing shortages and vulnerabilities

Drug shortages in the United States have already been rising, and dependence on China is one of the key reasons. Reports in 2025 highlighted dozens of shortages, including some cancer drugs and hospital‑critical medicines, where supply chains were tied to a small number of foreign ingredient suppliers.

Another problem is poor transparency: manufacturers are often not required to disclose exactly where their ingredients come from, so patients and even regulators may not know how dependent a medicine is on China. This lack of visibility makes it harder to plan alternatives, stockpile critical items, or respond quickly when a crisis hits.

Impact of trade tensions and tariffs

Trade tensions and new tariffs have exposed how deep this dependence on China has become. In 2025, U.S. tariffs on some Chinese imports, including pharmaceutical‑related items, increased sharply, raising worries about higher costs for generic drugs that rely on Chinese APIs.

When tariffs or political disputes affect such a concentrated supply, companies can face both price shocks and uncertainty about future deliveries. This can discourage investment, delay production, and push more costs onto patients and insurers while the underlying dependence on China remains.

What the U.S. is doing to reduce dependence

U.S. policymakers now describe dependence on China for drug ingredients as a national security problem that requires long‑term solutions. A federal investigation launched under Section 232 is treating generic drug imports and their supply chains as a potential threat to U.S. resilience.

Proposed responses include onshoring more API and drug manufacturing, providing tax incentives and grants for new plants, and building strategic stockpiles of essential medicines. Another key step is mapping the entire supply chain—from raw chemicals to finished pills—to understand exactly where dependence on China is highest and where backup capacity is needed.

Diversifying away from a single supplier

Reducing dangerous dependence on China does not mean cutting off all trade; it means avoiding a single point of failure. Experts argue for a mix of onshoring and “friend‑shoring,” where critical production is spread across trusted partners in regions such as Europe, North America, and selected Middle Eastern and Asian allies.

Some reports suggest that countries linked through newer diplomatic frameworks could collaborate to host alternative manufacturing hubs for APIs and key materials. By building multiple, geographically diverse sources, the United States can lower the risk that any one country, including China, can disrupt access to vital medicines.

What this debate means for ordinary Americans

For ordinary Americans, dependence on China shows up in the form of drug shortages, price spikes, and uncertainty about whether important treatments will be available when needed. When supply chains are fragile, even a small disruption can force hospitals to ration medicines, switch patients to less effective alternatives, or delay treatments.

A safer, more resilient system would make sure that no critical medicine depends on a single foreign supplier, especially not in a strategic rival country. Building that system will require investment and time, but it can protect both public health and national security by turning today’s dependence on China into a more balanced and secure network of suppliers.