China Stock Markets Slip As Policy Hopes Fade – Shocking Reality For Global Investors

China stock markets slip again as fading policy hopes shake investor confidence and raise new questions about the strength and direction of the world’s second-largest economy. Recent market moves show how cautious government strategy, persistent property sector weakness, and rising trade tensions are reshaping investment sentiment at home and abroad.

China Stock Markets Slip Amid Weak Sentiment

At midday trading, major Chinese indexes such as the CSI300 and the Shanghai Composite recorded slight declines of about 0.1%, signaling a cautious mood rather than a full-scale sell-off. Hong Kong’s Hang Seng Index fell more sharply, dropping around 0.8% as regional investors expressed disappointment over the lack of bold new support measures. These small but telling moves show how sensitive china stock markets slip whenever policy expectations and reality diverge.

Investors had been hoping for large-scale stimulus to revive growth, but the latest signals from Beijing suggest a more measured and gradual approach. The gap between expectations and policy announcements is translating into choppy price action, particularly in sectors that depend heavily on domestic demand and government support.

Policy Hopes Fade As Beijing Stays Cautious

Recent guidance from the Politburo indicates that China’s leaders prefer cautious macro management over aggressive, one-off stimulus packages. Instead of announcing sweeping reforms or massive spending programs, policymakers have emphasized “boosting demand” and revived a previously shelved commitment to “cross-cyclical adjustment” through 2026, implying fine-tuning and gradual intervention rather than shock therapy.

This measured stance is one of the key reasons why china stock markets slip when policy meetings end without dramatic surprises. Traders who position for a big stimulus rally are forced to reconsider their strategies, and short-term sentiment can turn negative even if the long-term policy direction remains supportive.

Export Strength Masks Structural Risks

One factor behind Beijing’s confidence is the continued resilience of China’s export engine. Research from major institutions suggests that policymakers are somewhat reassured by strong export performance, even as domestic sectors like property and consumption struggle. Recently, China recorded an annual trade surplus exceeding 1 trillion dollars for the first time, underlining the scale of its manufacturing and export power.

This trade surplus is not just large; it is also changing in composition. Export flows are increasingly shifting away from the United States toward markets in Europe, Australia, and Southeast Asia. For now, this diversification supports growth and helps stabilize corporate earnings, but it also lays the ground for new frictions, especially with Western partners facing rising deficits and political pressure at home.

Rising Trade Tensions And Global Fallout

As china stock markets slip, global investors are paying closer attention to trade discrepancies and potential policy backlash from key partners. Europe’s growing trade deficit with China is attracting scrutiny from politicians and regulators who are under pressure to defend local industries. Economists warn that this imbalance could trigger new tariffs, anti-dumping measures, or regulatory barriers in sensitive sectors such as electric vehicles, batteries, and green technology.

Any escalation of trade tensions would not only weigh on Chinese exporters but also ripple across supply chains worldwide. Multinational firms depend heavily on Chinese manufacturing, and new restrictions could create uncertainty for earnings, capital flows, and pricing in multiple asset classes. For investors, this means that china stock markets slip may be a signal of deeper global realignments, not just a domestic story.

Property Market Woes Drag On Sentiment

One of the clearest reasons why china stock markets slip repeatedly is the prolonged downturn in the property sector. Expectations of a major, game-changing rescue for real estate developers and homebuyers have faded over time. Instead of aggressive bailouts, authorities have opted for targeted and conditional support, which has not been enough to trigger a strong recovery in prices or sales volumes.

Weakness in property weighs heavily on several parts of the market. Real estate developers face ongoing financing stress, banks carry rising credit risks, and local governments struggle with shrinking land sale revenues. As property, commodity, and consumer-related stocks remain under pressure, investor sentiment becomes more defensive, and the overall index performance suffers.

Sector Rotation As China Stock Markets Slip

Because broad-based stimulus has not materialized, investors are rotating away from vulnerable sectors into areas seen as more resilient or policy-favored. While property and traditional consumer names lag, export-driven industries and select technology companies are attracting more attention.

In Hong Kong, however, the latest bout of weakness has hit technology and energy stocks particularly hard, reflecting both local concerns and global risk-off moods. When china stock markets slip, traders often reassess their exposure to emerging markets, and Hong Kong’s tech-heavy listings can become a lightning rod for volatility. Understanding which sectors are gaining policy support and which are being left to adjust on their own is now crucial for any China-focused strategy.

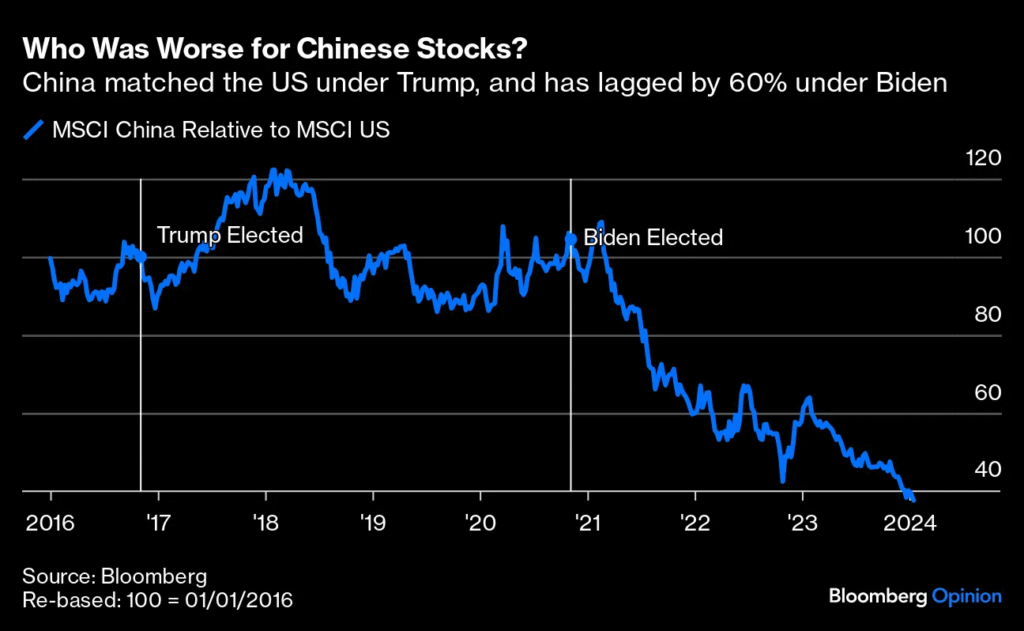

Why China Stock Markets Slip Matters For Global Investors

The behavior of Chinese equities is increasingly important for international portfolios, indices, and asset allocation decisions. When china stock markets slip because policy under-delivers on expectations, it can affect:

- Global risk sentiment, as traders use Chinese assets as a barometer for emerging market health.

- Commodity prices, since China remains a major consumer of energy, metals, and raw materials.

- Corporate earnings for multinational firms that rely on Chinese demand or supply chains.

Even modest daily moves can signal deeper shifts in the underlying narrative: from “big bang stimulus” to “slow, managed adjustment,” and from “limitless export growth” to “rising trade confrontation.” Investors who track these signals can better manage risk and identify opportunities.

Practical Takeaways For Investors

When china stock markets slip due to fading policy hopes, investors may consider several practical points:

- Reassess stimulus expectations: Avoid over-reliance on a single “big bang” policy event and instead prepare for gradual, targeted measures.

- Watch sector-specific signals: Property, consumer, and financial stocks may remain under pressure, while export-driven and policy-favored industries could offer relative resilience.

- Monitor trade policy headlines: Potential tariffs or new regulations from Europe or other partners could quickly shift the outlook for Chinese exporters.

- Balance risk and diversification: Exposure to China can be part of a diversified portfolio, but position sizing and hedging become more important during periods when china stock markets slip frequently.

Staying informed through high-quality macro and market research helps investors respond intelligently rather than react emotionally to every move in Chinese indexes.

Conclusion:

China stock markets slip as cautious policies, a weak property sector, and rising trade tensions weigh on investor confidence and reshape opportunities in Asia’s biggest economy. As traditional growth drivers lose momentum, market focus is shifting toward export-led companies and select technology names that can still benefit from global demand. Is environment mein investors ko short-term rallies se zyada, policy direction, sector fundamentals, aur trade headlines par nazar rakhni chahiye. Global portfolios ke liye, jab china stock markets slip, to ye sirf local risk ka signal nahi hota, balki commodities, emerging markets, aur multinational earnings par bhi asar dal sakta hai. Isi liye, informed, diversified, aur sector-selective rehna ab China-exposed investors ke liye sab se important strategy ban gaya hai.