Amazing 5 Key Changes in Pakistan Budget 2024-25 Every Citizen Should Know

Amazing 5 Key Changes in Pakistan Budget 2024-25 Every Citizen Should Know are not just about big numbers, they directly touch your salary, bills and shopping basket. The federal budget for 2024-25 aims to increase tax collection, manage debt and satisfy IMF conditions while still trying to offer some support to people and businesses.

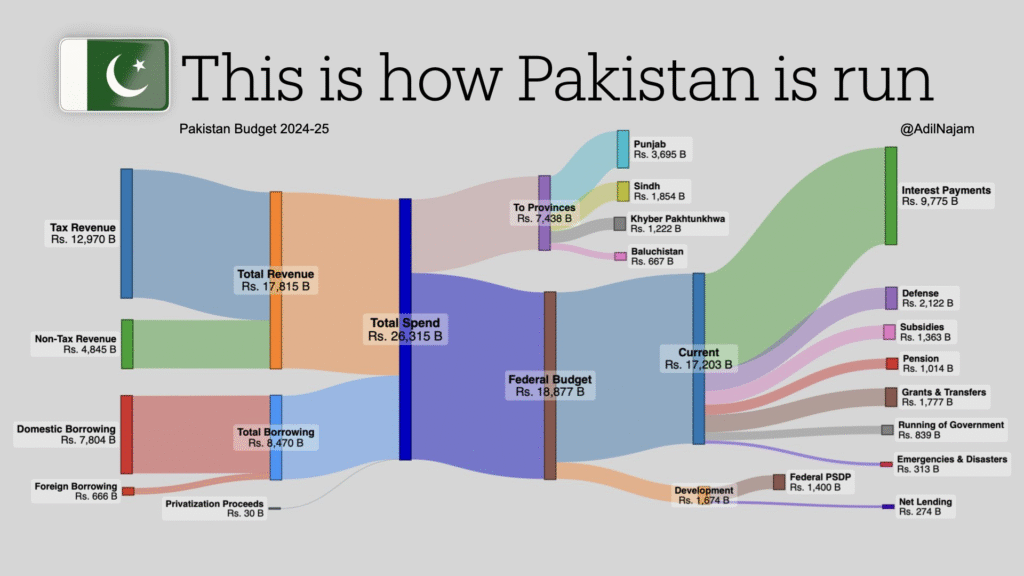

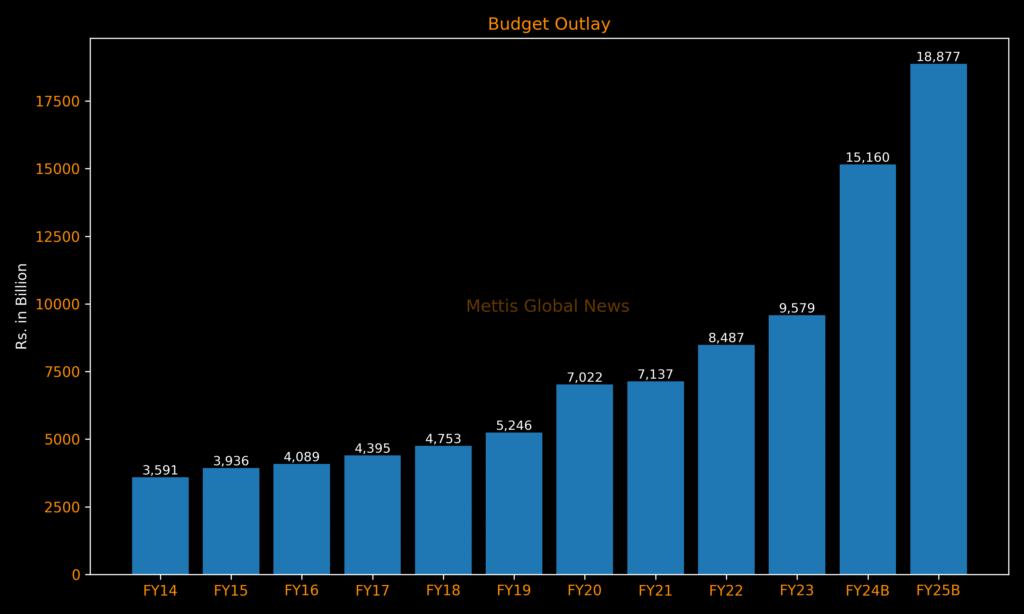

The government has set an ambitious tax revenue target of around PKR 13 trillion, which is about 40 percent higher than the previous year, showing how serious it is about closing the fiscal gap. At the same time, a Public Sector Development Programme of about PKR 1.15 trillion has been approved to fund roads, energy, education and health projects.

1. Amazing 5 Key Changes in Pakistan Budget 2024-25 for income tax

One of the amazing 5 key changes in Pakistan Budget 2024-25 Every Citizen Should Know is the new income tax structure. The budget keeps the top rate for the salaried class at 35 percent but changes the way different slabs are taxed, which affects how much tax many people pay each month.

For non‑salaried individuals and Associations of Persons, the maximum income tax rate has been raised from 35 percent to 45 percent, which hits high‑earning professionals and some businesses. Dividend tax on certain mutual funds that earn more than half their income from profit‑on‑debt has also been increased from 15 percent to 25 percent, making such investments less tax‑friendly.

On the other hand, there is an additional 10 percent surcharge on salaried people and AOPs with annual income above Rs 10 million, further increasing their total tax bill. These changes show that the government is trying to collect more from higher earners while broadening the tax net to meet revenue targets under IMF supervision.

2. Amazing 5 Key Changes in Pakistan Budget 2024-25 in sales tax and prices

Another of the amazing 5 key changes in Pakistan Budget 2024-25 Every Citizen Should Know is the shift in sales tax policy. The Finance Bill plans to remove many exemptions, zero ratings and reduced rates, moving more goods and services to the standard 17 percent GST rate.

This means that items that used to enjoy lower sales tax may now become more expensive, affecting daily spending on goods and some services. While a few products may move to reduced rates, the general move is toward a simpler but broader GST system that can bring in more revenue.

For citizens, this change can show up as higher prices on certain items, especially where businesses pass the full tax onto customers. At the same time, the government argues that a cleaner tax structure can improve fairness and reduce loopholes, which have long reduced the tax base.

3. Amazing 5 Key Changes in Pakistan Budget 2024-25 in development spending

The third of the amazing 5 key changes in Pakistan Budget 2024-25 Every Citizen Should Know is the Public Sector Development Programme (PSDP). The budget approves around Rs 1.15 trillion for PSDP, which will fund projects in energy, infrastructure, water, education and health.

These funds are important because they can create jobs and improve services if projects are managed well and not delayed. Roads, power plants and dams often bring long‑term benefits, but they also require strict monitoring to prevent cost overruns and wastage.

However, with such a tight fiscal position, there is always a risk that development spending gets cut during the year if revenue targets are missed. That is why many analysts remind that real impact depends on actual releases and execution, not just the announced PSDP number.

4. Amazing 5 Key Changes in Pakistan Budget 2024-25 linked to IMF and debt

The fourth of the amazing 5 key changes in Pakistan Budget 2024-25 Every Citizen Should Know is how closely it is linked to the IMF programme and debt management. The government wants to reduce the fiscal deficit from about 7.4 percent of GDP to around 5.9 percent, which is a key demand from lenders.

To do this, the budget increases the overall tax target and also cuts or rationalizes some subsidies and exemptions. At the same time, the country has to pay high interest on its large public debt, which takes a big share of total spending and leaves less room for welfare.

Analysts say the IMF’s support depends on Pakistan sticking to realistic revenue plans and controlling spending so that debt does not grow out of control. For citizens, this often means tighter conditions, possible utility price adjustments, and limited space for large new subsidies.

5. Amazing 5 Key Changes in Pakistan Budget 2024-25 that affect everyday life

The last of the amazing 5 key changes in Pakistan Budget 2024-25 Every Citizen Should Know is the impact on everyday life, from salaries to business costs. With higher tax rates on some income groups and broader GST, many people may feel pressure on their monthly budgets.

People in the middle class can see more deductions from salaries and possible price increases on goods they buy regularly. Small businesses and professionals may also face higher tax rates and stricter documentation requirements, which can increase compliance costs.

At the same time, if PSDP projects move forward and the economy stabilizes under the IMF‑backed plan, there can be better job opportunities and smoother growth in the medium term. The real challenge is surviving the short‑term squeeze while hoping for long‑term stability and lower inflation.

How citizens can respond to these amazing 5 key changes in Pakistan Budget 2024-25

Understanding the amazing 5 key changes in Pakistan Budget 2024-25 Every Citizen Should Know helps you plan your finances better. People can review their monthly budgets, track tax deductions on salaries and check if they fall in changed slabs.